A legacy of learning: Leave behind a gift that matters

The next time you are trying to decide on a gift for a child, consider getting them something that will have a lasting impact on their life: Help them pay for college. It may not be as exciting as—or provide the instant gratification of—the latest gadget or other big-ticket item, but when it’s time to pay the tuition bill, that gift will be more meaningful.

Several options for giving are available—and it can be complicated trying to understand the nuances and tax deductions—so we asked Dustin Dowling to shed some light. Dustin is managing partner at Peters Wealth Advisors LLC and has a way of understanding each family’s needs to tailor the best financial solution for them.

“These financial decisions must be made on a case-by-case basis. What works for one family may not work for another family. In some cases, more than one strategy will be necessary to accomplish the needs of educating children and retiring successfully.”

—Dustin Dowling, managing partner, Peters Wealth Advisors LLC

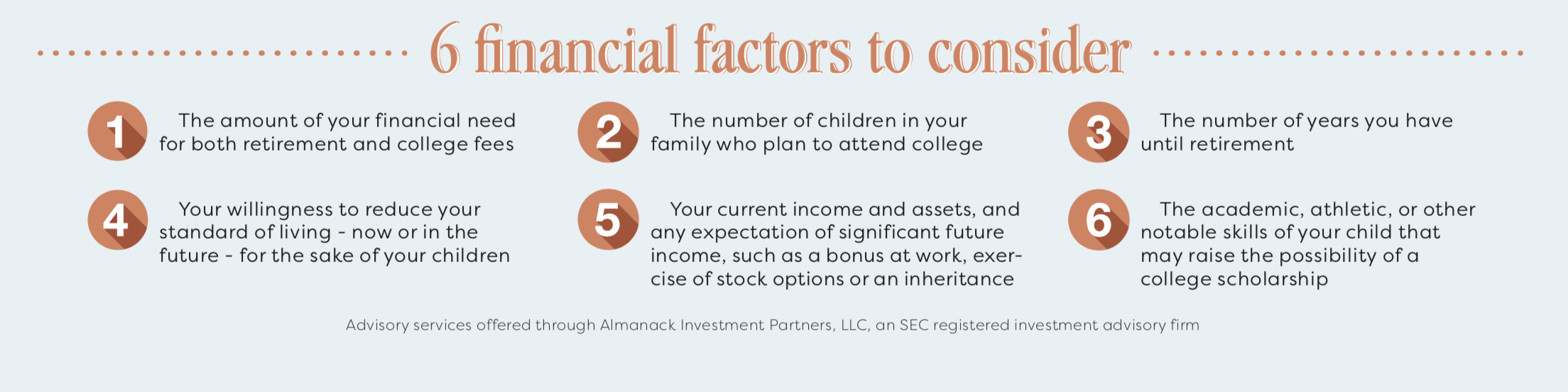

These days, it’s not uncommon for parents to postpone starting a family until both spouses are settled in their marriage and careers, often well into their 30s and 40s. Though this financial security can be an advantage, it can also present a dilemma: The need to save for college and retirement at the same time. One of the realities parents may face is that they can’t afford to fund 100% or even 50% of their child’s college education. This is often an emotional issue, but the right advisor can help you make the best decision for your family.

If you are a business owner, you have unique college planning opportunities. If you are in a high tax bracket, it may be advantageous for you to shift assets or income to your child, who will typically be in a lower tax bracket. Generally, you can shift some business income to your child using one of the following four strategies:

1. Gift company stock to your child

2. Transfer a partnership or S corporation interest to your child

3. Arrange a gift-leaseback transaction with your child

4. Put your child on the company payroll

The common theme in all of these strategies is shifting business assets or income to someone in a lower tax bracket to take advantage of lower tax rates.

Speaking of taxes, there are two education tax credits—the American Opportunity credit and the Lifetime Learning credit—that provide some relief to families in the midst of financing their children’s college education. Dustin explains it this way: “As a general rule, a tax credit is a dollar-for-dollar reduction against taxes owed, and it is therefore more valuable than a tax deduction of the same dollar amount.”

For more information on how you can leave your legacy of learning, contact Dustin and his team of advisors at 225-766-4885 or visit peterswealth.com.